|

The New

American Dream Job Is Pretty Dull

Actuarial science graduates earn six-figure

salaries and have a better-than-average

unemployment rate.

By Riley Griffin

September 10, 2018

Taking on student debt is a financial risk.

Those in the best position to pay it off

after graduation are those who study exactly

such risks.

Actuarial science, the formal term for the

study of insurance, was ranked the most

valuable college major, according to a

Bankrate.com report released on Monday.

Actuarial science majors earn an average

annual salary of $108,658 and have a

better-than-average unemployment rate at 2.3

percent. And at a time when student debt is

at a record high, these graduates are less

likely to incur the added expense of

additional schooling and delayed earning

potential. Less than 1 in 4 graduates pursue

advanced degrees.

“The actuarial science profession is

interesting because students don’t need

advanced degrees to gain livable wages, but

instead are certified through a series of

exams overseen by the industry’s

professional organizations,” said

Bankrate.com analyst Adrian Garcia in an

interview. “Students typically pass one to

two of these exams while in school and then

go on and complete others while working,

earning raises and bonuses as they pass.”

The study ranked 162 majors with labor forces of at least 15,000 people based on

average annual income, employment status and whether those graduates went on to

pursue a higher degree within 12 months. Income accounted for 70 percent of the

weighted ranking, unemployment for 20 percent and 10 percent was awarded to

career paths that did not demand additional education. The data was derived from

the U.S. Census Bureau’s 2016 American Community Survey.

Recent actuarial science graduates are entering the industry at an opportune

moment. The U.S. property and casualty insurance industry took in $18 billion in

net profit, even as the country sustained heavy losses from natural catastrophes

such as hurricanes Harvey, Irma and Maria, according to the National Association

for Insurance Commissioners. But that number is expected to increase in 2018 due

to favorable interest rates, shows the S&P Global Market Intelligence report.

Health-care premiums are also on the rise as many insurers seek double-digit

percentage increases in monthly costs for individual medical plans in 2019.

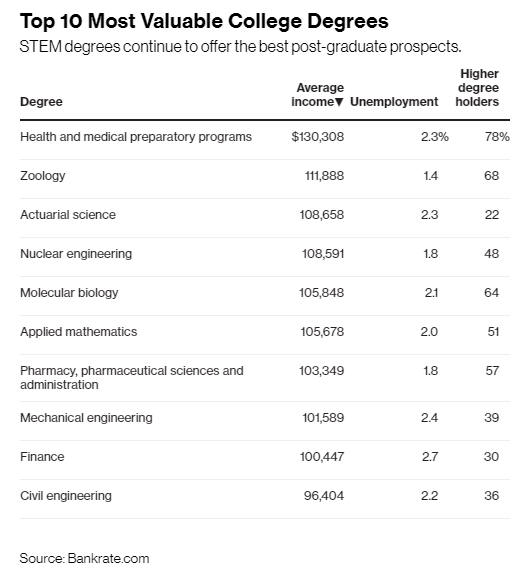

Science, technology, engineering and mathematics degrees continue to offer the

best postgraduate prospects to college students, the study found. Zoology,

nuclear engineering, premedical programs and applied mathematics dominated the

five most valuable degrees, offering graduates low rates of unemployment and

six-figure salaries.

But the prospect of a high salary doesn’t always win out. Petroleum engineering

graduates boast the most lucrative average salary, topping out at $124,448, but

fail to crack the top of the list because of an excessively high 7.9 percent

unemployment rate.

The only students faring worse than fine arts degree holders are niche fine arts

degree holders. Graduates with degrees outside the traditional buckets of art,

theater, music or creative writing earn the second-lowest average annual salary

of $40,855 and have the highest unemployment rate of any major at a whopping 9.1

percent.

“At the end of the day, you have to balance being practical and following your

passion,” Garcia said.

|